What Are Stablecoins, and Why Should You Know About Them?

Gabriel Soares | Nov 26, 2025

Blockchains are changing how we pay. They’re set to hold over $4.4 trillion in B2B cross-border payments by 2024. The crypto payment market is also growing by 16.6% yearly. While the US is the biggest blockchain payment app user, Asia Pacific is quickly catching up.

All these trends make one thing clear — banks must embrace blockchain technology or risk being replaced by it.

In a previous blog post, we discussed what blockchain is and how it works, but today we’re looking at how it applies to payment services.

At its core, a blockchain is a decentralized digital ledger that records transactions across multiple computers in a network. Its design ensures that data remains secure, transparent, and immutable. Transactions recorded cannot be changed or tampered with — a feature that makes it ideal for financial transactions.

Blockchains are quickly achieving widespread acceptance in the global financial industry. Fintech companies are fiercely competing to develop blockchain platforms, and the list of banks using blockchain payments is longer than ever:

Beyond banks, governments around the world are also using blockchains to streamline financial governance. The Netherlands is testing a pension blockchain system to lower costs and improve data privacy. Singapore’s Project Ubin explores the use of blockchains for clearing and settling payments and securities. South Africa has been successfully using blockchain technology for efficient high-volume interbank settlements. And in the Philippines, the blockchain-based i2i platform now links rural banks that were once disconnected from the country’s financial network.

Blockchain technology promises to transform domestic payments, cross-border transactions, trade finance, and tax payments by:

Conventional payment systems require gateways and issuers. While these mediators are critical for confirming payment validity, they add costs and slow down transactions. Blockchains remove these intermediaries to speed up settlements.

Transaction records saved securely in a blockchain are visible to everyone and cannot be changed. Each block contains its unique hash and the previous block’s hash, creating a connected sequence that makes it tamper-resistant and easy to track funds.

Remittances form a significant portion of the GDP in several developing countries — 29% in Haiti, slightly over 10% in the Philippines, and 2.7% in Mexico. These fund transfers make up about 0.7% of the world’s total GDP each year, representing roughly $1 trillion.

Money transfer operators like Western Union have historically dominated remittance markets, with banks acting cautiously due to challenges in cross-border transactions. Now blockchain-based payment companies like Abra, BitPesa, and Circle enable secure, global person-to-person transfers.

Blockchain technology removes intermediaries to allow quick international transfers while securing payments with its immutability. For banks, this is an opportunity to generate substantial revenue from handling both large and small remittances for a small transaction fee.

Smart contracts can automatically pause payments if terms are breached, reducing the risk of fraud. They also ensure transparency between parties because the blockchain’s code — not a potentially fallible or biased human agent — manages enforcement. This ultimately minimizes disputes and allows efficient resolutions when disagreements arise.

Blockchains can potentially extend basic banking services to underserved sectors. After all, around 1.1 billion unbanked people own a mobile phone — and their first encounter with financial services will likely be through a mobile blockchain platform.

Blockchains can also serve as financial safeguards in regions experiencing economic problems. For example, when inflation levels soared uncontrollably in Argentina and Turkey, people explored stablecoins as alternative wealth storage options.

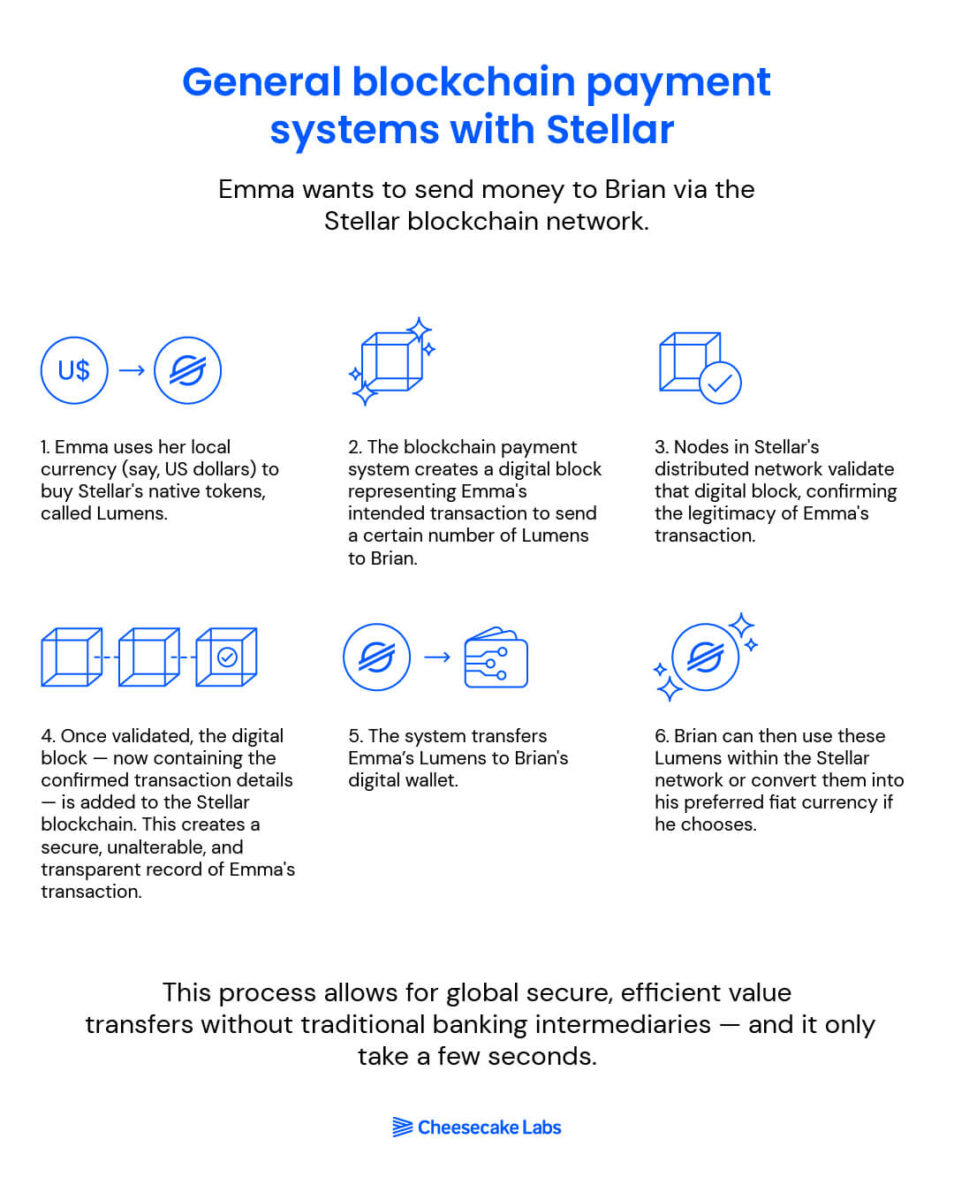

Now that we’ve looked at the advantages of blockchain in finance let’s illustrate the processes involved in general and cross-border blockchain payment transactions.

Emma wants to send money to Brian via the Stellar blockchain network.

This process allows for global secure, efficient value transfers without traditional banking intermediaries — and it only take a few seconds.

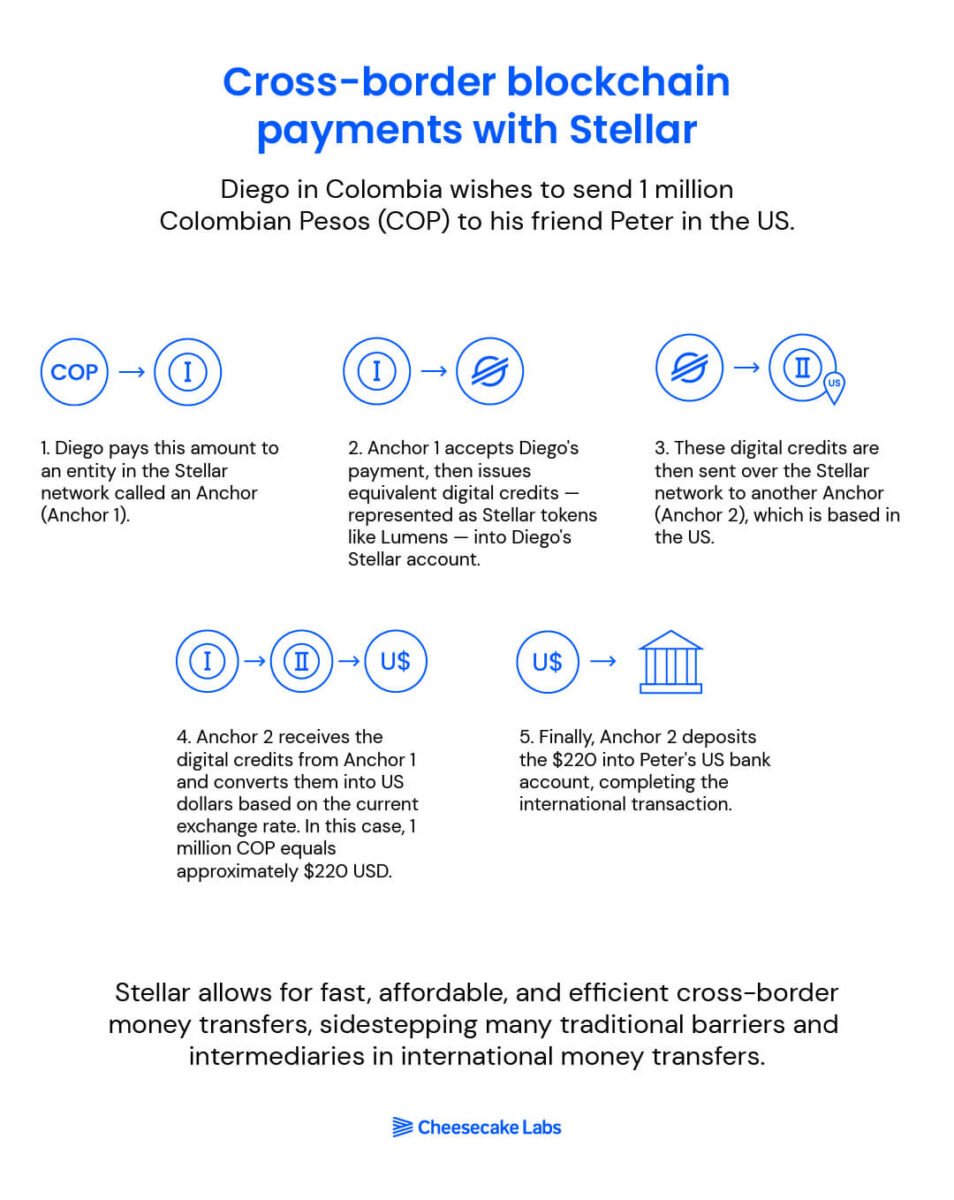

Diego in Colombia wishes to send 1 million Colombian Pesos (COP) to his friend Peter in the US.

Stellar allows for fast, affordable, and efficient cross-border money transfers, sidestepping many traditional barriers and intermediaries in international money transfers.

Once mainly a topic for Bitcoin fans, blockchains have gained interest from mainstream finance. Take a look at some of the companies and organizations using blockchain payment solutions to change how money is paid and transferred:

PayPal now allows all eligible US customers to engage in cryptocurrency transactions. They can transfer supported digital coins into their PayPal accounts, transfer cryptocurrency from their accounts to external exchanges and hardware wallets, and send cryptocurrency to family and friends instantaneously without fees or network charges.

Moreover, PayPal facilitates crypto checkout at numerous merchant locations worldwide.

Mastercard offers go-to-market planning and commercialization guidance to help fintech companies expand into new markets. They also assist central banks in exploring CBDC development and implementation.

As one of the world’s largest cryptocurrency exchanges, the Coinbase platform lets millions of users securely buy, sell, store, spend, earn, and convert cryptocurrencies. This blockchain payment gateway also allows businesses to establish crypto wallets, create non-fungible tokens, and even earn interest and rewards on their crypto assets.

The Stellar blockchain network is known for low remittance costs, mobile banking capabilities, instantaneous settlements (within two to five seconds), and automated currency exchange. It also allows global access to stablecoins like USDC.

What’s more, the Stellar Anchor Network offers new cash-out points (like ACH in the US, mobile money in Kenya, and SEPA in Europe) to let end-users convert their digital assets into local currencies. These features — along with simple onboarding and support for less liquid currencies — make it easier for digital wallet companies to quickly expand their customer base.

No wonder the Stellar ecosystem is flourishing. Banks and fintech companies are using its ability to work seamlessly with other systems to create innovative products and services.

Cheesecake Labs is a proud Stellar integration partner. We have used the platform to build a digital currency management system for Mercado Bitcoin and help TASCOMBANK develop a digital token, among other exciting projects.

Even with their advantages, blockchains must overcome some hurdles to truly reach their transformative potential.

Find out more about our blockchain development services.

Below is a simplified look at the steps to building a blockchain payment system.

To dive deeper, read our previous blog on how to create a blockchain payment platform.

Decide whether to create your own cryptocurrency or use an existing one. Both approaches have their advantages and drawbacks. Creating your own cryptocurrency gives you complete control over its features and specifications, but it requires a lot of time and resources. Using an existing cryptocurrency like Bitcoin or Ethereum is quicker and simpler, but you have to adapt your business to the rules and conventions of that currency.

Define your objectives, identify your target audience, and outline how the blockchain payment system will fit into your existing business model. This is the time to consider legal and regulatory requirements, as blockchain transactions are subject to various regulations depending on your location.

This team should ideally include blockchain developers, project managers, business analysts, and quality assurance professionals. If you don’t have the necessary skills in-house, you can partner with a reputable blockchain development firm. At Cheesecake Labs, we can provide you with a dedicated team to fit your requirements.

Your development team builds the blockchain payment system according to the project plan. Regular monitoring and adjustments keep the project on schedule and within budget.

Building a blockchain payment system presents both potential cost benefits and challenges due to its multifaceted nature. But it’s crucial to understand the key characteristics that make blockchain-based payments more cost-effective compared to traditional systems:

Cheesecake Labs brings a wealth of experience in building blockchain applications, wallets, and exchanges utilizing Ethereum, Polygon, Optimist, Arbitrum, and our specialty — Stellar.

We’re working with Tascombank on Ukraine’s CBDC pilot to make public sector payroll more efficient. CBDCs combine the security and convenience of digital currencies with the reliability of a traditional banking system.

We were also involved with the Stellar Aid program, which uses the stablecoin USDC to distribute aid directly to refugees at a large scale. Recipients can then exchange their USDC for local currency at MoneyGram outlets, reducing the risk of fund misuse often observed in traditional aid systems.

Aside from these great projects, we’ve spearheaded several proof-of-concept projects showcasing Stellar’s benefits and practicality in areas like general payments, bulk payroll disbursements, and blockchain cross-border payments.

Contact us for a comprehensive consultation on your blockchain payment project. Our team can help you achieve your goal, whether you want to build a blockchain service platform or enhance your internal processes with blockchain technology. We can’t wait to hear about your ideas!

With several years of experience in customer services, my background goes through several areas of technical support, from incident handling and real-time support to on-site service delivery and Knowledge Management through the KCS Methodology, as well as project and product management.